OURADIUM

The New Standard of Digital Gold

Physical gold. Blockchain technology. Swiss trust.

Launched from Zurich, Ouradium is a stablecoin 100% backed by physical gold, designed for institutional investors, corporate treasuries, and global crypto community enthusiasts.

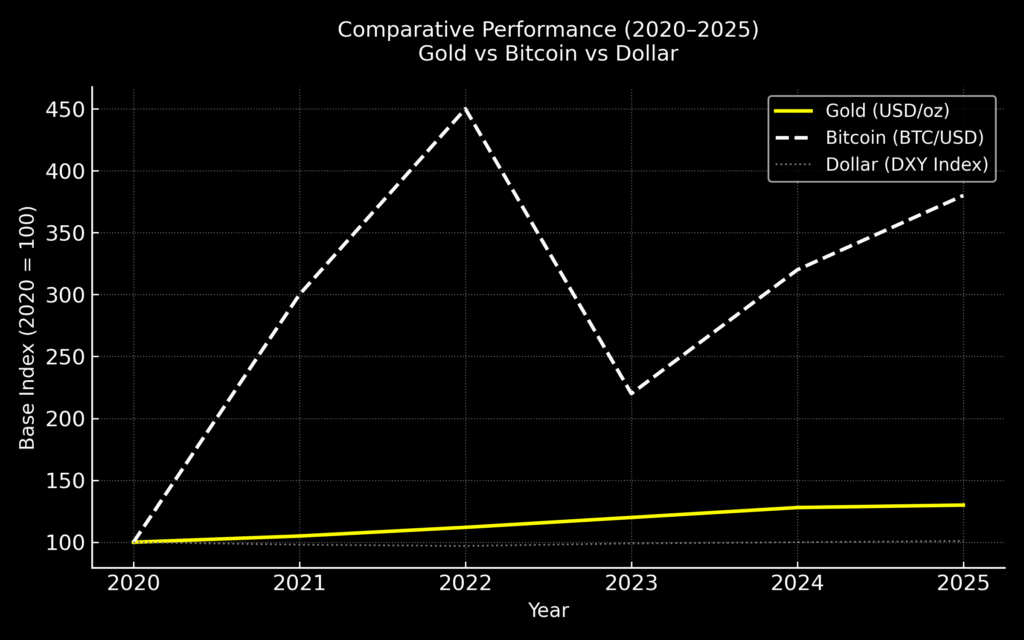

The Ouradium Token (ORD) combines the timeless stability of gold with the speed and flexibility of blockchain, offering 24/7 liquidity, unmatched transparency, and protection against inflation and economic crises.

Whether for portfolio diversification or DeFi integration — Ouradium is the future of digital gold.

About us

Ouradium (ORD) represents direct ownership of allocated physical gold, securely stored in high-security vaults in Switzerland.

Each token is backed by a fraction of gold audited by independent third parties such as BDO Switzerland, and is redeemable through authorized institutional channels.

With tons of gold under custody, Ouradium bridges the trust of traditional assets with the innovation of blockchain technology.

Use Case Example: An investment fund diversifies its portfolio with ORD, gaining exposure to gold without the logistical costs of physical storage, while trading tokens in real time on platforms such as Uniswap.

Why Choose Ouradium?

Proven Stability:

Full Transparency:

Global Liquidity:

Flexible Redemption:

Secure Custody:

DeFi Integration:

Passive Income via Staking:

Use Case Example:

How Ouradium Works

1. Secure Issuance: Physical gold is allocated in Swiss vaults, audited by third parties, and tokenized at a 1:1 ratio.

Example: 1 ORD = 1 gram of gold.

2. Global Trading: ORD is traded on blockchains such as Ethereum and Solana, with upcoming listings on exchanges like Binance and DeFi protocols such as Uniswap.

3. Full Transparency: Use explorers like Etherscan to verify reserves, or review monthly audit reports available on the Ouradium website.

4. Simplified Redemption: Institutions can redeem ORD for physical gold (e.g., delivery of bars in Zurich) or fiat equivalents via partners such as Swiss banks.

5. Stake and Earn:Lock ORD in audited smart contracts for 6, 9, 12, 18, or 24 months to earn yields of 0.1%, 0.3%, 0.6%, 1.0%, or 1.5%.

Rewards are paid monthly in ORD and can be tracked through blockchain explorers.

Exemplo de Caso de Uso:

A corporate treasury redeems 1,000 ORD for 1 kg of physical gold to diversify its reserves, with coordinated delivery within 48 hours.

Custody and Auditing

The gold is stored in Swiss vaults operated by Brink’s, with monthly audits conducted by independent firms such as BDO.

Public reports disclose total gold holdings (e.g., 10 tons in Q1 2026) and their 1:1 correspondence with issued tokens.

On-chain tools allow real-time verification of gold backing, ensuring full transparency and trust.

Verification Example:

An investor scans a QR code on the Ouradium website to access an on-chain report confirming that 1 ORD = 1 gram of gold held in a specific vault.

Compliance and Governance

Headquartered in Zurich, Ouradium adheres to Swiss KYC/AML standards, ensuring compliance with global financial regulations.

A governance committee—composed of financial experts and external auditors—publishes quarterly reports and safeguards the project’s integrity.

Compliance Example:

Before redeeming or staking 5,000 ORD, an institution undergoes a KYC verification within 24 hours, ensuring full compliance with FINMA regulations.

Tokenizing Trust, Certifying Gold

1. Executive Summary

Overview of the project, mission, positioning, and OURADIUM’s unique value proposition.

Certified and traceable gold tokenized on blockchain.

Integration with certification authorities.

Hybrid model (institutional custody + federated issuance).

Optional physical conversion.

Alignment with international standards (LBMA, JORC, RJC, OECD).

2. Global Context and Problem

- • Lack of traceability and verifiable certification in gold mining.

- • Fragmentation of sustainability (ESG) standards..

- • Limited access of small mining operations to formal markets.

- • Investor distrust regarding the actual backing of digital assets.

3. OURADIUM Solution

- • Blockchain platform for gold tokenization and certification.

• Direct integration with certified refiners and auditors.

• Use of smart contracts and certification NFTs (CertNFT).

• Proof-of-Reserve and ESG oracles ensure full transparency.

• Enables decentralized token issuance by certified mining entities.

4. Technical Architecture

4.1 OURADIUM Network Layers

- • Physical Layer: Mines, refineries, vaults.

- • Digital Layer: EVM blockchain, CertNFT, ESG oracles, IPFS.

- • Institutional Layer: DAO, audits, certifiers, regulators.

4.2 Smart Contracts

- • ORD (ERC-20 gold-backed token)

- • CERTNFT (NFT with ESG, provenance, and audit metadata)

- • Compliance Oracle: Integrates certifications, audits, and reserves.

4.3 Proof-of-Reserve

- • Automated system proving the physical backing of each ORD token.

- • Custody and certification data recorded in real time.

5. Custody and Issuance Model

5.1 Hybrid Structure

- • Level 1 – Institutional Custody: Official vaults.

- • Level 2 – Federated Issuance: Certified mining operators.

- • Fungible tokens with individual traceability (metadata).

5.2 Issuance Flow

1. Certification (CertNFT issued).

2. DAO validation.

3. Minting of corresponding ORD tokens.

4. Recording of physical reserves.

6. Tokenomics

Item:Detail

Token: ORD (1:1 with physical gold gram)

Type: ERC-20 (fungible)

Linked Certificate: CERTNFT

Authorized Issuers: Certified vaults and mining companies

Proof-of-Reserve:On-chain audits

Physical Redemption:Yes (subject to fee and logistics)

ESG Staking: Miners can lock tokens as compliance collateral

DAO Governance: Partner voting on audits and fees

Transparency: Public on-chain dashboard

7. Certification and ESG

• Standards aligned with RJC, LBMA, and OECD

• Each CertNFT includes:

– Provenance (mine geolocation)

– ESG audit data

– Purity and weight

– Cryptographic hash and IPFS link

8. DAO Governance (OURADIUM Council)

- • Hybrid governance model representing miners, certifiers, vaults, and investors.

- • Weighted voting system (Proof of Stake + ESG Reputation).

- • Approves new issuers and contract updates.

9. Compliance and Regulation

- • Adheres to KYC/AML standards, external audits, and Proof-of-Reserve reporting.

10. Roadmap and Strategy

MVP + CertNFT Integration + ESG Oracle: Q4 2025

Formal Partnerships (Miners, Banks): Q1 2026

Pilot Launch + DEX Listing: Q2 2026

DAO Activation + Public Proof-of-Reserve: Q3 2026

LATAM Expansion + New Commodities (Niobium, Lithium): 2027 +

11. Impact and Future Vision

- • Standardization of mineral certification through blockchain.

- • Productive inclusion of small and medium mining operations.

- • Attraction of sustainable capital (Green Finance + ESG).

- • International interoperability with exchanges and regulators.

12. Conclusion

OURADIUM defines a new paradigm for gold:

“Certified, traceable, and tokenized gold — tangible trust in digital form.”

13. Technical Annex

- • Flow diagrams (architecture, DAO, Proof-of-Reserve).

- • Contract structures (ORD / CERTNFT pseudocode).

- • Technical glossary (blockchain, ESG, mineral certification).